Derivative MTM group

Every new derivative contract that is created will be assigned to a MTM Group. By default, the system will create a new MTM group for each derivative that is created when the derivative is assigned to “Default” strategy of any book. “Default” Strategy is a system generated Strategy used to hold/park a derivative contract when it is not assigned to a specific Strategy on contract approval/creation in the system.

For Futures/Options, the name of the MTM group is combination of Commodity Name & Pricing Period.

For Swaps, the name of the MTM group is combination of Commodity Name & Counterparty Name & Pricing Start Date & Pricing End Date.

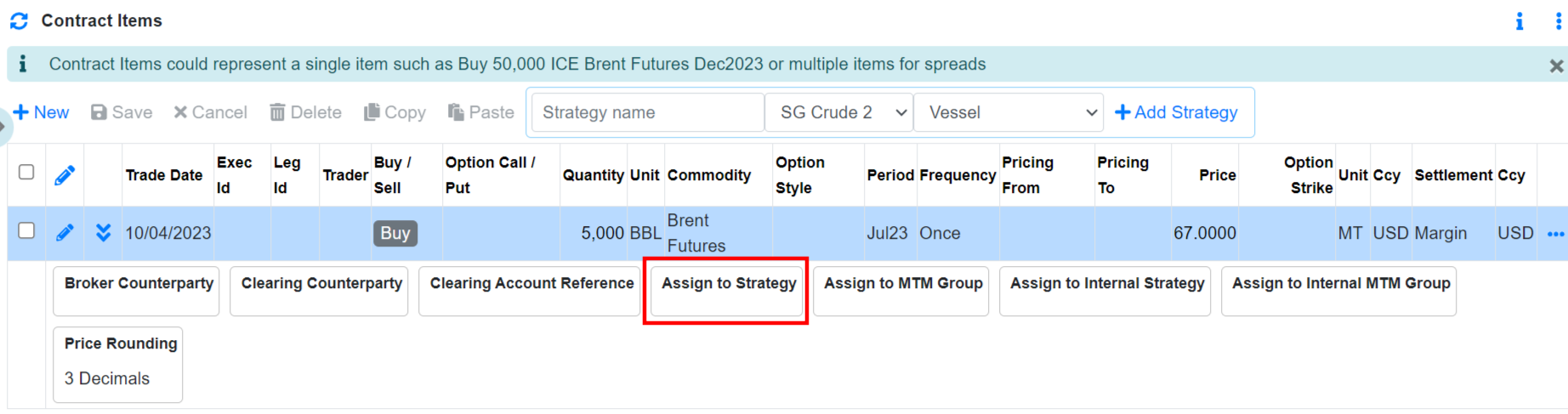

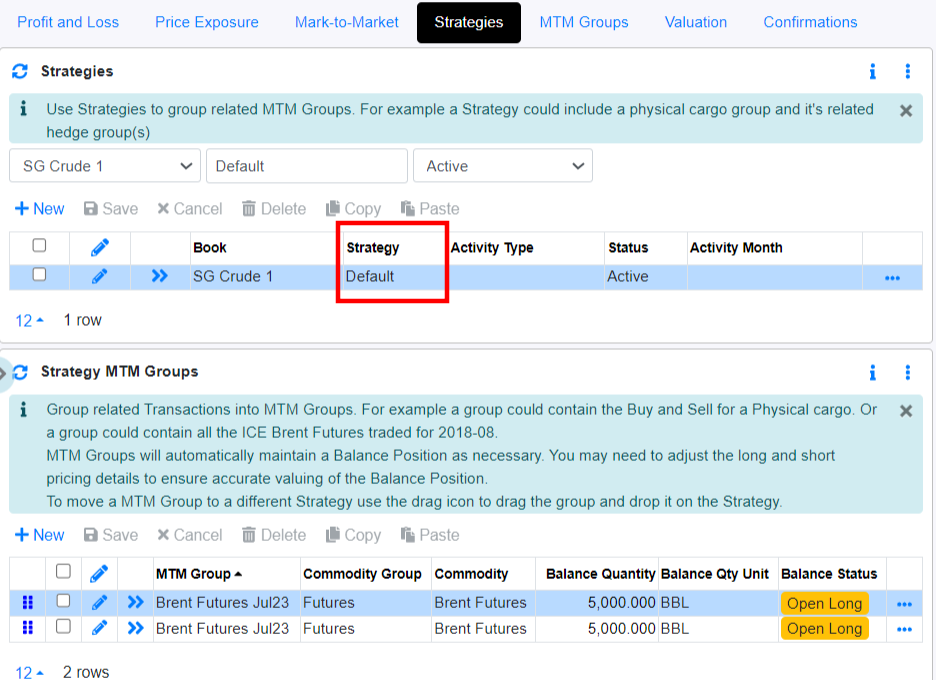

For Example, if 2 Futures contract - Brent Futures JUL 23 is created and it was not assigned to a specific strategy in contract item.

After the 2 Futures contract are approved/created, the 2 contracts will be assigned to 2 different MTM groups of same name in the “Default” Strategy.

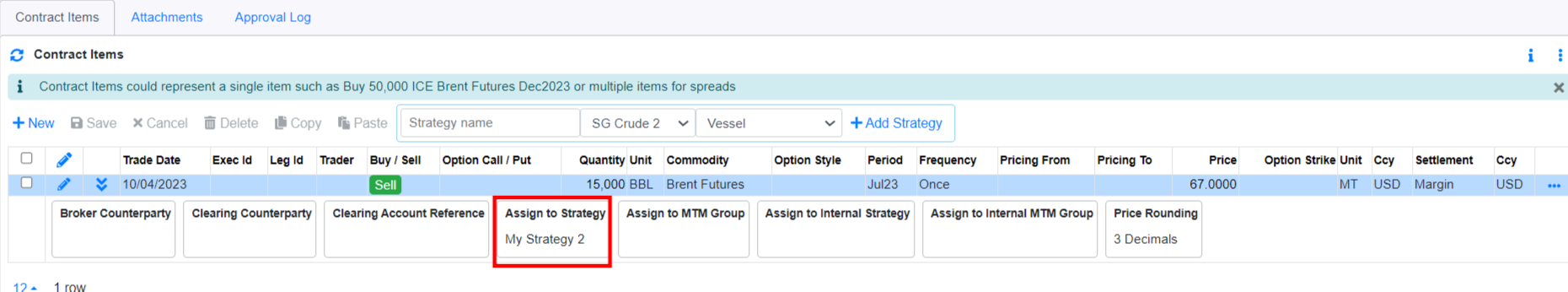

For Example, if 2 Futures contract - Brent Futures JUL 23 is created and it was assigned to a specific strategy in contract item.

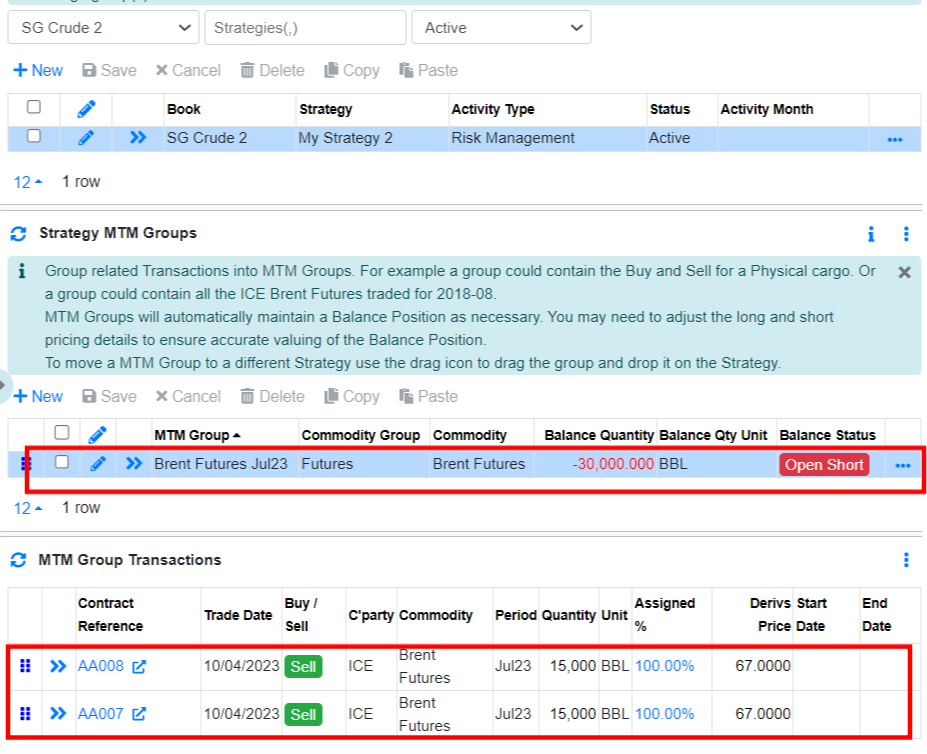

After the 2 Futures contract are approved/created, the 2 contracts will be grouped to the same MTM group in “My Strategy 2” Strategy as both contracts have same commodity name and pricing period..

**The logic of assigning/grouping of transactions to same or different MTM group is the same for paper deal import**

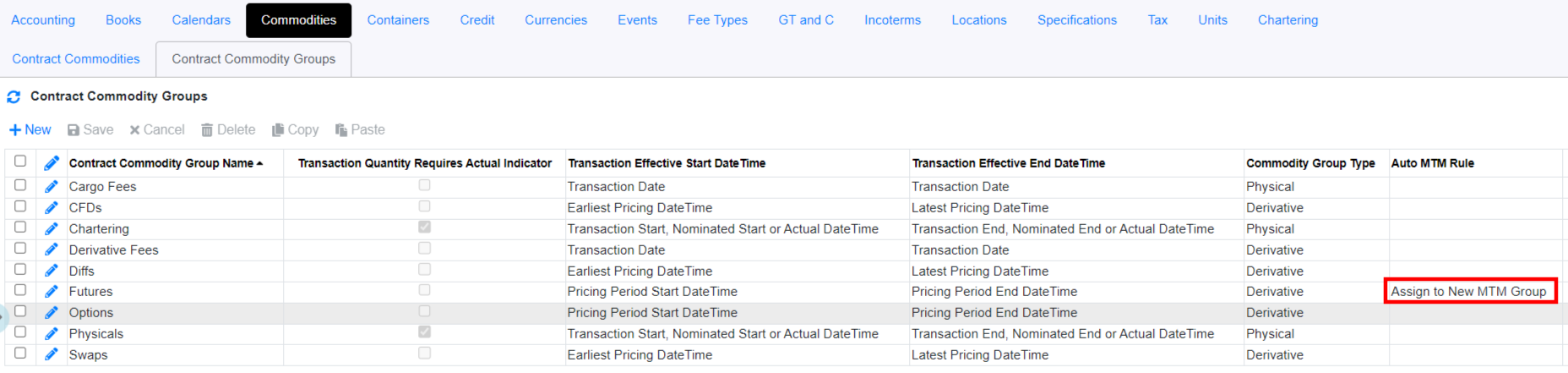

It is possible to set a derivatives contract to always split into new MTM group even if the derivatives are assigned to a specific Strategy. To do this, the below setup needs to be change.

In Reference Data → Commodities → Contract Commodity Group, set the “Auto MTM Rule” to "Assign to New MTM Group"

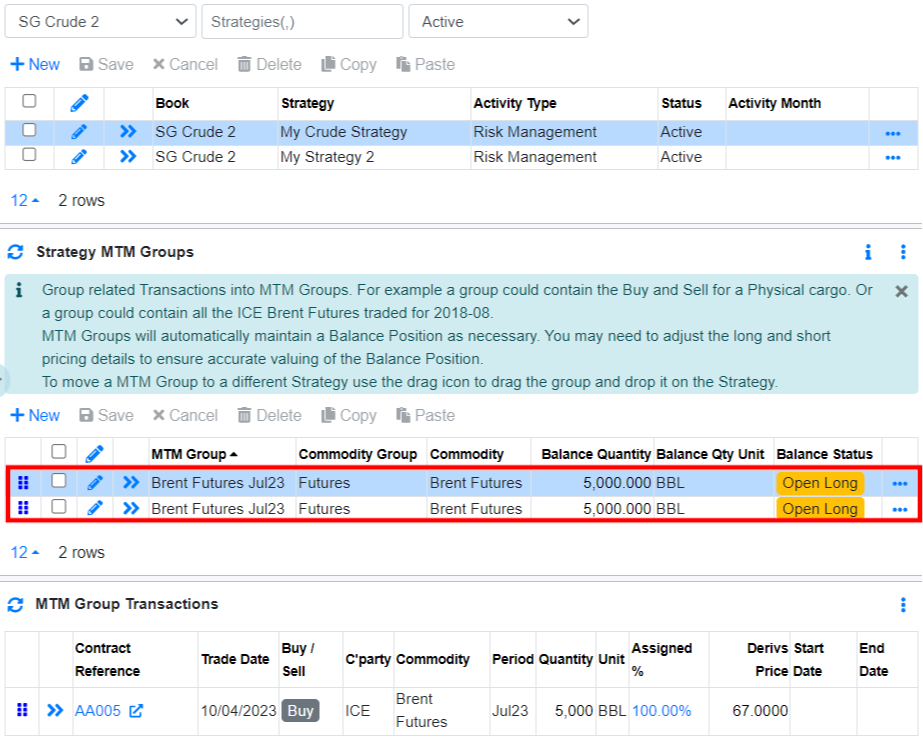

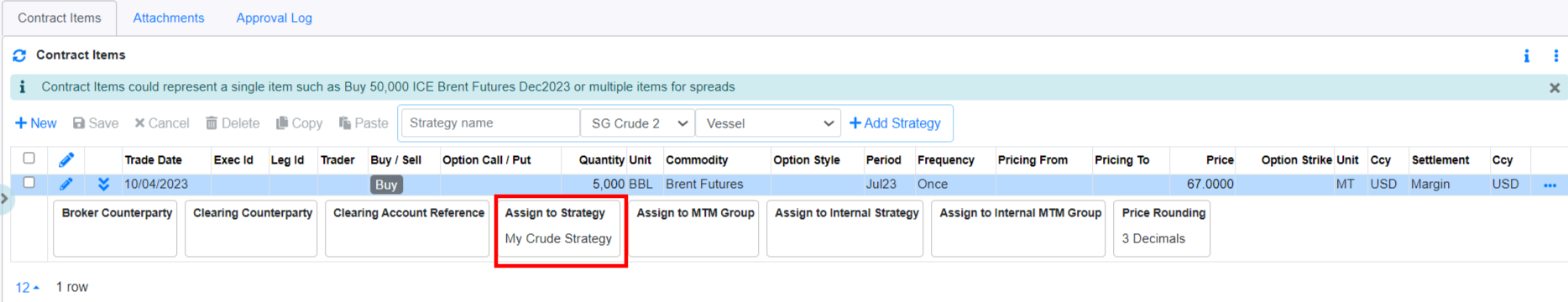

For Example, if 2 Futures contract - Brent Futures JUL 23 is created and it was assigned to a specific strategy in contract item.

After the 2 Futures contract are approved/created, the 2 contracts will be assigned to 2 different MTM groups of same name in the “My Crude Strategy” Strategy due to the setup change above.