To add a new price series go to Price Data and then to the Price Series tab.

There are a 4 type of price series that can be setup in the system. The price series type are Dated, Forward, Posting and Spot. Dated price series type are specifically for Dated Brent. Posting price series type are used for price series which typically publishes one price quote per month. For example : DAS OSP or Basrah OSP, etc.

Setting up Spot Price Series

Setting up Forward Price Series

Setting up Posting Price Series

Setting up Futures Price Series

Setting up Spot Price Series

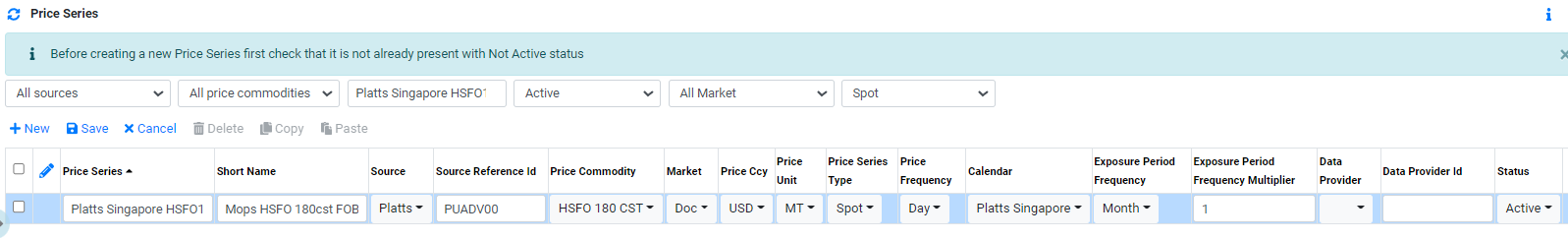

To add a Spot Price Series, in Price Series view:

- Click on

to create a new line.

to create a new line. - In Price Series, enter the name of the spot price series. The name needs to be unique for each price series in the system.

- In Short Name, enter the short name of the spot price series. This short name can be used for selection or for reporting purposes.

- In Source, select the source of the spot price series. This information is for reference only.

- In Source Reference Id, enter a source reference id associated with this spot price series. This is typically the Platts id for prices provided by Platts.

- In Price Commodity, select the price commodity for the spot price series. Price commodity is additional grouping or information used to identify the price series.

- In Market, select the Market for the spot price series. Market is additional grouping or information used to identify the price series.

- In Price Ccy, select the currecny associated with the spot price series. This indicate the default currency for this price series.

- In Price Unit, select the units associated with the spot price series. This indicate the default unit for this price series. If contract price series unit is different from this unit, Coversion will be used when during valuation process.

- In Price Series Type, select Spot for spot price series.

- In Price Frequency, select the frequency of the spot price series. Typically frequency is day for Oil related commodites and week is for coal.

- In Calendar, select the calendar associated with this spot price series. The system will use this calendar to determine the holiday associated with this price series.

- In Exposure Period Frequency, select the frequency of the exposure period. The Exposure Frequency determines the Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set to "Month".

- In Exposure Period Frequency Multiplier, enter the multiplier for the exposure period. The Exposure Multiplier determines the number of Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set 1.

- In Data Provider, select the data provider for the spot price series. Data provider is additional grouping or information used to identify the price series.

- In Data Provider Id, enter applicable data provider id for the spot price series. This id is typically used for automatic price import.

- In Active?, tick the box to set the price series active.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*New Source can be added from Price Data -> Sources.*

*New Price Commodity can be added from Price Data -> Price Commodities.*

*New Market can be added from Price Data -> Markets.*

*Calendar setup can be found in Reference Data -> Calendar*

*If there is a need to change the Exposure Period Frequency and multiplier other than Month and 1, please contact CoreTRM Support.*

*New Data Provider can be added from Price Data -> Data Providers.*

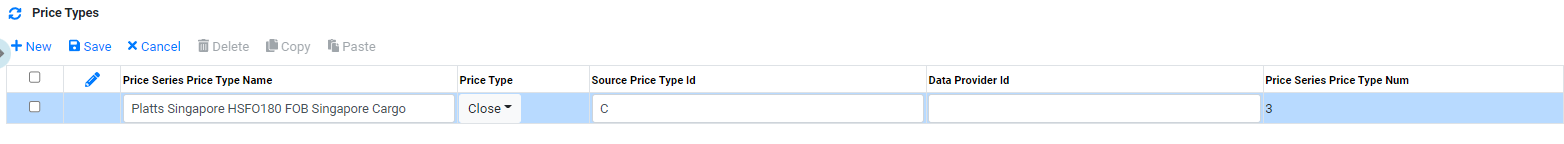

To add a Spot Price Series, in Price Type view:

- Click on

to create a new line.

to create a new line. - In Price Series Price Type name, enter the name of the spot price series. The name can be the same as the price series name in price series view. This is the name that appear in most of the view in the system.

- In Price Type, select the applicable price type. The list of price type are High, Low, Close, MTM, Posting, Settle ,Open Interest and Volume. The price type is used for informational purpose only. For Spot prices, Close can be used.

- In Source Price Type Id, enter the applicable source price type id. This field can be leave blank.

- In Data Provider Id, enter applicable data provider id for the spot price series. This id is typically used for automatic price import.

- In Price Series Price Type Num, this field will be populated with a unique id for this price series price type.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

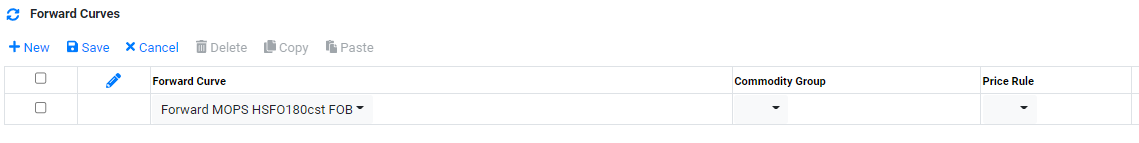

To add/assigned a forward curve for the spot price series, in Forward Curve view:

*Before a forward curve can be assigned to a spot price series, a Forward Curve is required to be setup. You can setup a new Forward Curve in Price Data -> Forward Curves*

- Click on

to create a new line.

to create a new line. - In Forward Curve, select the applicable forward curve for this price series.

- In Commodity Group, select the applicable commodity group for this forward curve. Spot price series' Forward curve normally doesnt required a commodity group.

- In Price Rule, select price rule if applicable. Roll one day early is used for Ice Brent Futures.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*New Forward Curve can be setup in Price Data -> Forward Curve.*

Setting up Forward Price Series

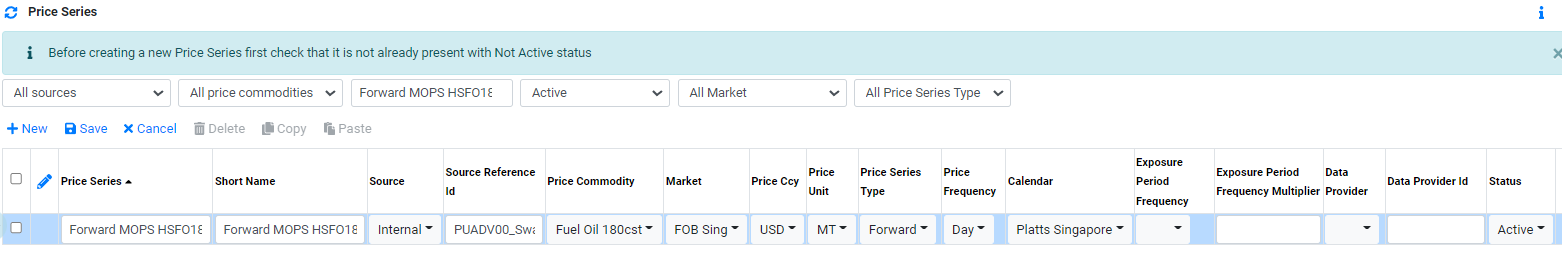

To add a Forward Price Series, in Price Series view:

- Click on

to create a new line.

to create a new line. - In Price Series, enter the name of the forward price series. The name needs to be unique for each price series in the system.

- In Short Name, enter the short name of the forward price series. This short name can be used for selection or for reporting purposes.

- In Source, select the source of the forward price series. This information is for reference only.

- In Source Reference Id, enter a source reference id associated with this forward price series. This is typically the Platts id for prices provided by Platts.

- In Price Commodity, select the price commodity for the forward price series. Price commodity is additional grouping or information used to identify the price series.

- In Market, select the Market for the forward price series. Market is additional grouping or information used to identify the price series.

- In Price Ccy, select the currecny associated with the forward price series. This indicate the default currency for this price series.

- In Price Unit, select the units associated with the forward price series. This indicate the default unit for this price series. If contract price series unit is different from this unit, Coversion will be used when during valuation process.

- In Price Series Type, select Forward for forward price series.

- In Price Frequency, select the frequency of the forward price series.

- In Calendar, select the calendar associated with this forward price series. The system will use this calendar to determine the holiday associated with this price series. Typically it is the same calendar as its related price series.

- In Exposure Period Frequency, select the frequency of the exposure period. The Exposure Frequency determines the Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set to "Month".

- In Exposure Period Frequency Multiplier, enter the multiplier for the exposure period. The Exposure Multiplier determines the number of Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set 1.

- In Data Provider, select the data provider for the forward price series. Data provider is additional grouping or information used to identify the price series.

- In Data Provider Id, enter applicable data provider id for the forward price series. This id is typically used for automatic price import.

- In Active?, tick the box to set the price series active.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*New Source can be added from Price Data -> Sources.*

*New Price Commodity can be added from Price Data -> Price Commodities.*

*New Market can be added from Price Data -> Markets.*

*Calendar setup can be found in Reference Data -> Calendar*

*If there is a need to change the Exposure Period Frequency and multiplier other than Month and 1, please contact CoreTRM Support.*

*New Data Provider can be added from Price Data -> Data Providers.*

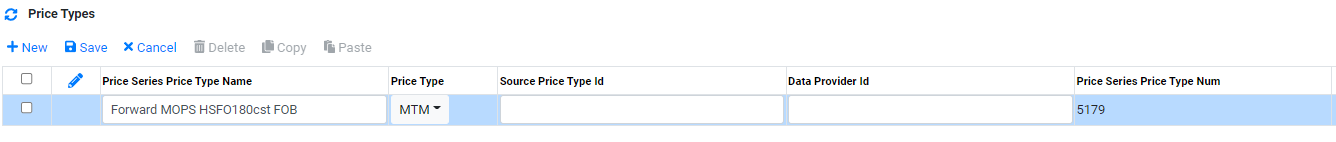

To add a Forward Price Series, in Price Type view:

- Click on

to create a new line.

to create a new line. - In Price Series Price Type name, enter the name of the forward price series. The name can be the same as the price series name in price series view. This is the name that appear in most of the view in the system.

- In Price Type, select the applicable price type. The list of price type are High, Low, Close, MTM, Posting, Settle, Open Interest and Volume. The price type is used for informational purpose only. For Forward prices, MTM can be used.

- In Source Price Type Id, enter the applicable source price type id. This field can be leave blank.

- In Data Provider Id, enter applicable data provider id for the forward price series. This id is typically used for automatic price import.

- In Price Series Price Type Num, this field will be populated with a unique id for this price series price type.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

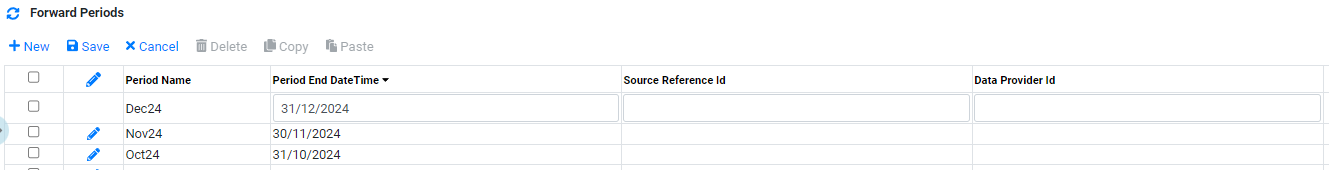

To add a Forward Price Series, in Forward period view:

- Click on

to create a new line.

to create a new line. - In Period Name, the period for which this foward price series will cover. Typically, it should cover next 2 years of Forward Period.

- In Period End Date Time, select the end date time of the period. Typically this will be the last pricing day of this period (One day before Expiry Date).

- In Source Reference Id, enter applicable source reference Id for this period. Typically, this is a reference use for automatic price import.

- In Data Provider Id, enter applicable data provider Id for this period. Typically, this is a reference use for automatic price import .

- Click

to confirm creation.

to confirm creation. - To edit Forward Period details after creation, Click

to edit.

to edit.

*New Forward Period can be setup in Price Data -> Period.*

*For Forward Price Series, Forward Curves is not required.*

Setting up Posting Price Series

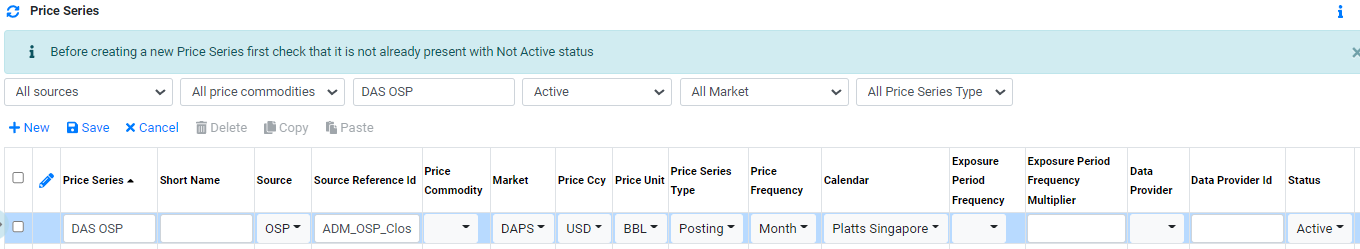

To add a Posting Price Series, in Price Series view:

- Click on

to create a new line.

to create a new line. - In Price Series, enter the name of the posting price series. The name needs to be unique for each price series in the system.

- In Short Name, enter the short name of the posting price series. This short name can be used for selection or for reporting purposes.

- In Source, select the source of the posting price series. This information is for reference only.

- In Source Reference Id, enter a source reference id associated with this posting price series. This is typically the Platts id for prices provided by Platts.

- In Price Commodity, select the price commodity for the posting price series. Price commodity is additional grouping or information used to identify the price series.

- In Market, select the Market for the posting price series. Market is additional grouping or information used to identify the price series.

- In Price Ccy, select the currecny associated with the posting price series. This indicate the default currency for this price series.

- In Price Unit, select the units associated with the posting price series. This indicate the default unit for this price series. If contract price series unit is different from this unit, Coversion will be used when during valuation process.

- In Price Series Type, select Posting for posting price series.

- In Price Frequency, select the frequency of the posting price series. Typically frequency is day for Oil related commodites and week is for coal.

- In Calendar, select the calendar associated with this posting price series. The system will use this calendar to determine the holiday associated with this price series.

- In Exposure Period Frequency, select the frequency of the exposure period. The Exposure Frequency determines the Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set to "Month".

- In Exposure Period Frequency Multiplier, enter the multiplier for the exposure period. The Exposure Multiplier determines the number of Exposure Period on Valuation Item (and therefore all the Exposure views). It needs to be set to generate Exposure. Typically, it is set 1.

- In Data Provider, select the data provider for the posting price series. Data provider is additional grouping or information used to identify the price series.

- In Data Provider Id, enter applicable data provider id for the posting price series. This id is typically used for automatic price import.

- In Active?, tick the box to set the price series active.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*New Source can be added from Price Data -> Sources.*

*New Price Commodity can be added from Price Data -> Price Commodities.*

*New Market can be added from Price Data -> Markets.*

*Calendar setup can be found in Reference Data -> Calendar*

*If there is a need to change the Exposure Period Frequency and multiplier other than Month and 1, please contact CoreTRM Support.*

*New Data Provider can be added from Price Data -> Data Providers.*

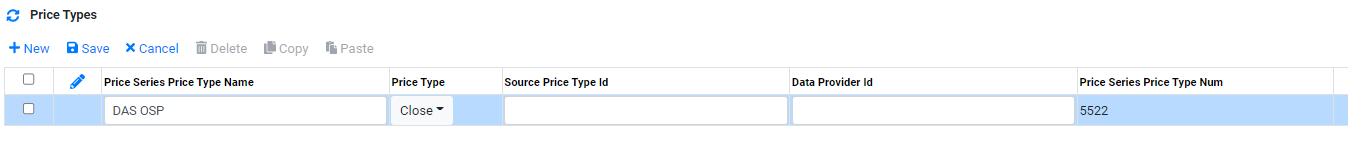

To add a Posting Price Series, in Price Type view:

- Click on

to create a new line.

to create a new line. - In Price Series Price Type name, enter the name of the posting price series. The name can be the same as the price series name in price series view. This is the name that appear in most of the view in the system.

- In Price Type, select the applicable price type. The list of price type are High, Low, Close, MTM, Posting, Settle, Open Interest and Volume. The price type is used for informational purpose only. For posting prices, Close can be used.

- In Source Price Type Id, enter the applicable source price type id. This field can be leave blank.

- In Data Provider Id, enter applicable data provider id for the spot price series. This id is typically used for automatic price import.

- In Price Series Price Type Num, this field will be populated with a unique id for this price series price type.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*For Posting Price Series, Forward Curves is not required.*

Setting up Futures Price Series

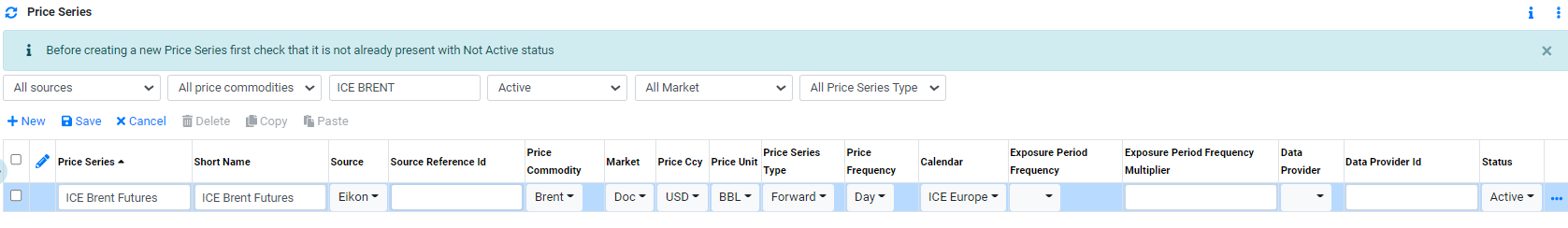

To add a Futures Price Series, in Price Series view:

- Click on

to create a new line.

to create a new line. - In Price Series, enter the name of the Futures price series. The name needs to be unique for each price series in the system.

- In Short Name, enter the short name of the Futures price series. This short name can be used for selection or for reporting purposes.

- In Source, select the source of the Futures price series. This information is for reference only.

- In Source Reference Id, enter a source reference id associated with this Futures price series. This is typically the exchange id for prices provided by exchange.

- In Price Commodity, select the price commodity for the Futures price series. Price commodity is additional grouping or information used to identify the price series.

- In Market, select the Market for the Futures price series. Market is additional grouping or information used to identify the price series.

- In Price Ccy, select the currecny associated with the Futures price series. This indicate the default currency for this price series.

- In Price Unit, select the units associated with the Futures price series. This indicate the default unit for this price series. If contract price series unit is different from this unit, Coversion will be used when during valuation process.

- In Price Series Type, select Forward for Futures price series.

- In Price Frequency, select the frequency of the Futures price series.

- In Calendar, select the calendar associated with this Futures price series. The system will use this calendar to determine the holiday associated with this price series.

- In Exposure Period Frequency, this is not required for Futures price series.

- In Exposure Period Frequency Multiplier, this is not required for Futures price series.

- In Data Provider, select the data provider for the Futures price series. Data provider is additional grouping or information used to identify the price series.

- In Data Provider Id, enter applicable data provider id for the Futures price series. This id is typically used for automatic price import.

- In Active?, tick the box to set the price series active.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

*New Source can be added from Price Data -> Sources.*

*New Price Commodity can be added from Price Data -> Price Commodities.*

*New Market can be added from Price Data -> Markets.*

*Calendar setup can be found in Reference Data -> Calendar*

*New Data Provider can be added from Price Data -> Data Providers.*

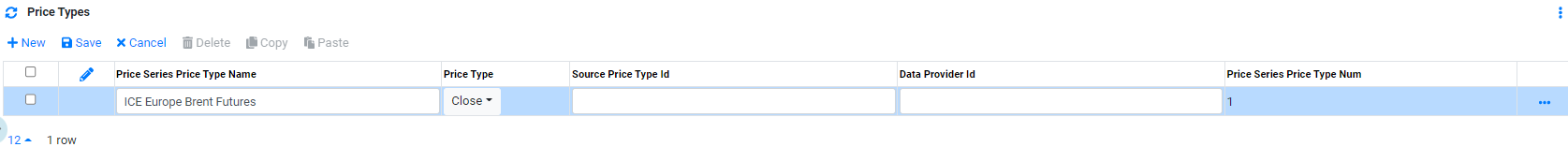

To add a Futures Price Series, in Price Type view:

- Click on

to create a new line.

to create a new line. - In Price Series Price Type name, enter the name of the Futures price series. The name can be the same as the price series name in price series view. This is the name that appear in most of the view in the system.

- In Price Type, select the applicable price type. The list of price type are High, Low, Close, MTM, Posting, Settle, Open Interest and Volume. The price type is used for informational purpose only. For Futures prices, Close can be used.

- In Source Price Type Id, enter the applicable source price type id. This field can be leave blank.

- In Data Provider Id, enter applicable data provider id for the futures price series. This id is typically used for automatic price import.

- In Price Series Price Type Num, this field will be populated with a unique id for this price series price type.

- Click

to confirm creation.

to confirm creation. - To edit price series details after creation, Click

to edit.

to edit.

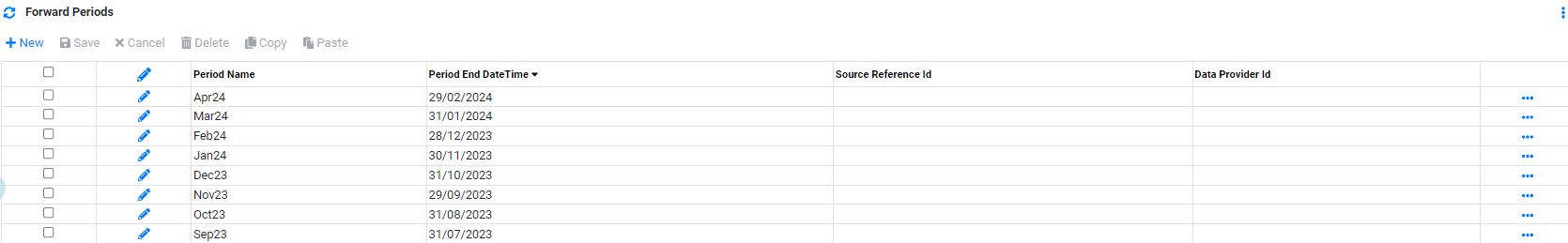

To add a Futures Price Series, in Forward period view:

- Click on

to create a new line.

to create a new line. - In Period Name, the period for which this foward price series will cover. Typically, it should cover next 2 years of Forward Period.

- In Period End Date Time, select the end date time of the period. Typically this will be the trading/pricing day of the futures contract.

- In Source Reference Id, enter applicable source reference Id for this period. Typically, this is a reference use for automatic price import.

- In Data Provider Id, enter applicable data provider Id for this period. Typically, this is a reference use for automatic price import .

- Click

to confirm creation.

to confirm creation. - To edit Forward Period details after creation, Click

to edit.

to edit.

*New Forward Period can be setup in Price Data -> Period.*

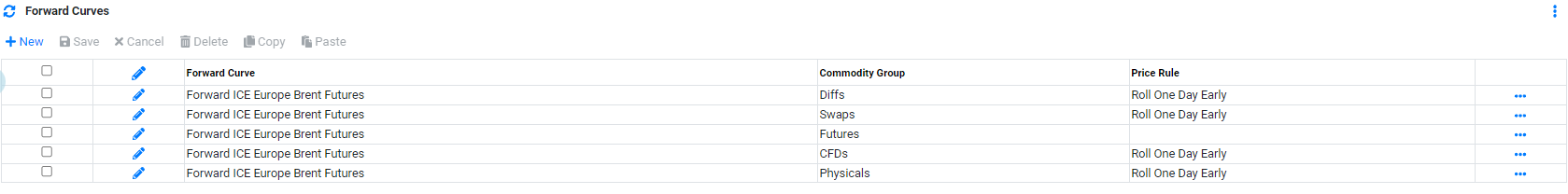

To add/assigned a forward curve for the Futures price series, in Forward Curve view:

*Before a forward curve can be assigned to a Futures price series, a Forward Curves is required to be setup. You can setup a new Forward Curve in Price Data -> Forward Curves*

- Click on

to create a new line.

to create a new line. - In Forward Curve, select the applicable forward curve for this price series.

- In Commodity Group, select the applicable commodity group for this forward curve. For Futures price series, each Commodity group requires a line, so that Price Rule can be assgined to it.

- In Price Rule, select price rule if applicable. Typically, for Swaps, Diffs and Phsyicals, Roll one day early is used is used.

- Click

to confirm creation.

to confirm creation. - To edit Forward Curve details after creation, Click

to edit.

to edit.

*New Forward Curve can be setup in Price Data -> Forward Curve.*

Browse More

- Overview

- Introduction and Navigation

- Quick Links

- Trading : Physical Deal Entry

- Trading : Paper Deal Entry

- Trading : Vessel Deal Entry

- Trading : Contract Fees

- Trading : Contract Specification

- Trading : Internal and Inter-entity Deal Entry

- Trading : MTM Groups

- Trading : Approvals

- Trading : Attachments

- Operations : Transaction Update

- Operations : Matching Buy/Sell Deal (Box Version)

- Operations : Matching Buy/Sell Deal (Table Version)

- Operations : Fees

- Operations : Specification Adjustment

- Operations : Inventory

- Operations : Letter of Credit

- Accounting : Fees

- Accounting : Settlement and Invoicing

- Risk Management : Strategies

- Risk Management : Valuations

- Risk Management : RM Dashboard Profit and Loss

- Risk Management : RM Dashboard Price Exposure

- Credit : Credit Exposure

- Credit : Companies

- Price Data : Prices

- Price Data : Price Series

- Price Data : Forward Curves

- Price Data : Exchange Rates

- Price Data : Formulae

- Price Data : Setup

- Reference Data : Accounting

- Reference Data : Books

- Reference Data : Calendars

- Reference Data : Commodities

- Reference Data : Container

- Reference Data : Credit

- Reference Data : Currencies

- Reference Data : Event

- Reference Data : Fee Type

- Reference Data : GT and C

- Reference Data : Incoterms

- Reference Data : Location

- Reference Data : Shipping

- Reference Data : Specification

- Reference Data : Tax

- Reference Data : Units